How much risk should I take with my pension?

- Karen Doyle

- Feb 27, 2024

- 3 min read

Updated: Mar 1, 2024

In general, when it comes to investing, the greater the risk you take, the greater the potential reward. Over time, this has resulted in individuals who have invested in the stock markets realizing higher returns compared to those who opted for safer alternatives like government bonds or bank deposits.

The stock market is affected by economic indicators such as employment, inflation, consumer spending as well as geopolitical factors such as wars, natural disasters and trade tensions. This causes the stock market to be unpredictable, and fluctuations are a natural part of how it works. However, since the stock market began equities have proven to be the best performing asset over the long term. So for this reason equities need to be a large portion of your fund but how much? A common rule of asset allocation is that you should hold a percentage of stocks that is equal to 100 minus your age. So if you're 40, you should hold 60% of your portfolio in stocks.

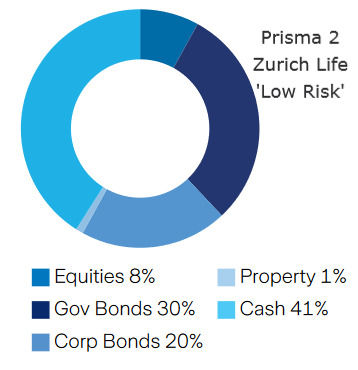

Most pension investors in Ireland are invested in a Lifestyle strategy that gradually reduces your equity exposure the closer you get to your chosen retirement age, with some companies moving you into defensive assets from as much as 15-20 years from retirement. If you arrive at retirement with all of your money in cash or bonds you may have left behind alot of money so it might be a good idea to take a closer look at your pension investment options and take control. The following graphics show the difference in asset allocation across the Prisma funds with Zurich Life which is similar to the spread across most Multi Asset funds on the market.

If you’re investing for 10 years or more and retirement isn’t on the horizon anytime soon, you can afford to be more adventurous. Investments tend to perform better over the long term so any bumps in the road along the way should be smoothed out as the stock market has plenty time to bounce back. However, market drops can be damaging for investors with a shorter timeframe. If a significant portion of your pension fund is invested in stocks, you may experience substantial losses, especially if you're close to retirement and have limited time to recover. Having said that, a higher allocation to equities means that during market downturns, the decline in your portfolio's value would primarily reflect the decrease in the value of your investment growth rather than the erosion of your initial investment.

The following table shows the return from the funds in the different risk bands in the last 10 years; showing the higher the risk, the higher the reward. Going up a level in the risk bands could make a huge difference to the pension pot you end up with. Prisma 5 has around 70% in equities as opposed to 45% in Prisma 4.

Prisma 2 | Prisma 3 | Prisma 4 | Prisma 5 | |

Annual return over the last 10 years | 1.2% | 3.2% | 6.7% | 9.2% |

No two investors are the same and there is no one size fits all approach to fund choice. What’s too risky for one person, might not be too risky to the next. The most important thing is to learn to understand how the market works, and what it means to take risk with the fund choices available to you.

If you need help with deciding on an appropriate fund(s) for your pension we offer a free pension consultation: https://calendly.com/oneplanfinancial/pension-consultation. A no obligation chat to see if we can help you retire better.

Warning: The value of your investment may go down as well as up.

Warning: Past performance is not a reliable guide to future performance.

Warning: If you invest you may lose some or all of the money you invest.

Comments